Why Ableton Is Thriving While Native Instruments Is Falling Apart

By Raymond Brigleb

in Studio Notes

I was thinking about the difference between Native Instruments and Ableton as music companies after someone on Reddit asked if Ableton was in “good shape”. Both are Berlin-based, both were founded in the late 90s, and both have had over 25 years to figure out what they want to be. The paths they've taken couldn't be more different.

Native Instruments spans an almost absurd number of product categories. They make DJ software and controllers (Traktor). They make MIDI keyboards (Komplete Kontrol). They make drum pad controllers and grooveboxes (Maschine). They sell one of the most sprawling software bundles in music production (Komplete, with over 150 instruments and effects). They're in a lot of different spaces.

Ableton, on the other hand, has been around almost exactly as long and yet feels so much more focused. Effectively, at this point they have four products:

- Ableton Live, their flagship music software

- Push, the hardware controller they've been iterating on since 2013

- Move, a portable groovebox released in late 2024

- Note, a companion app for iPhone

It took Ableton roughly 25 years to get to those four products. Their bread and butter has always been Live. But what's striking is that every one of those other products feeds directly back into it. Push is a control surface for Live. Move captures ideas that sync to Live. Note sketches beats that open in Live. Every product they ship makes all the others more valuable. Owning the hardware doesn't just complement the software — it deepens your investment in the whole ecosystem.

Native Instruments has been in most of those same markets for years. But there's no real synergy between them. If you own their DJ gear, sure, you‘d want Traktor. But nothing about that makes you more inclined to pick up a Maschine or a Komplete Kontrol keyboard. The products exist side by side, not interlocked. And NI has never quite been seen as the premium tier in any of those categories — just present in all of them.

I remember buying a Maschine years ago because I'd been trying to decide between the NI ecosystem and Ableton‘s. Right around that time, Ableton released Live 10, which featured a significant visual overhaul — updated vector graphics, a new custom typeface, thinned-out interface elements — all designed so the UI could scale cleanly to any display resolution. It was the kind of deep, unsexy infrastructure work that signals a company thinking in decades, not quarters.

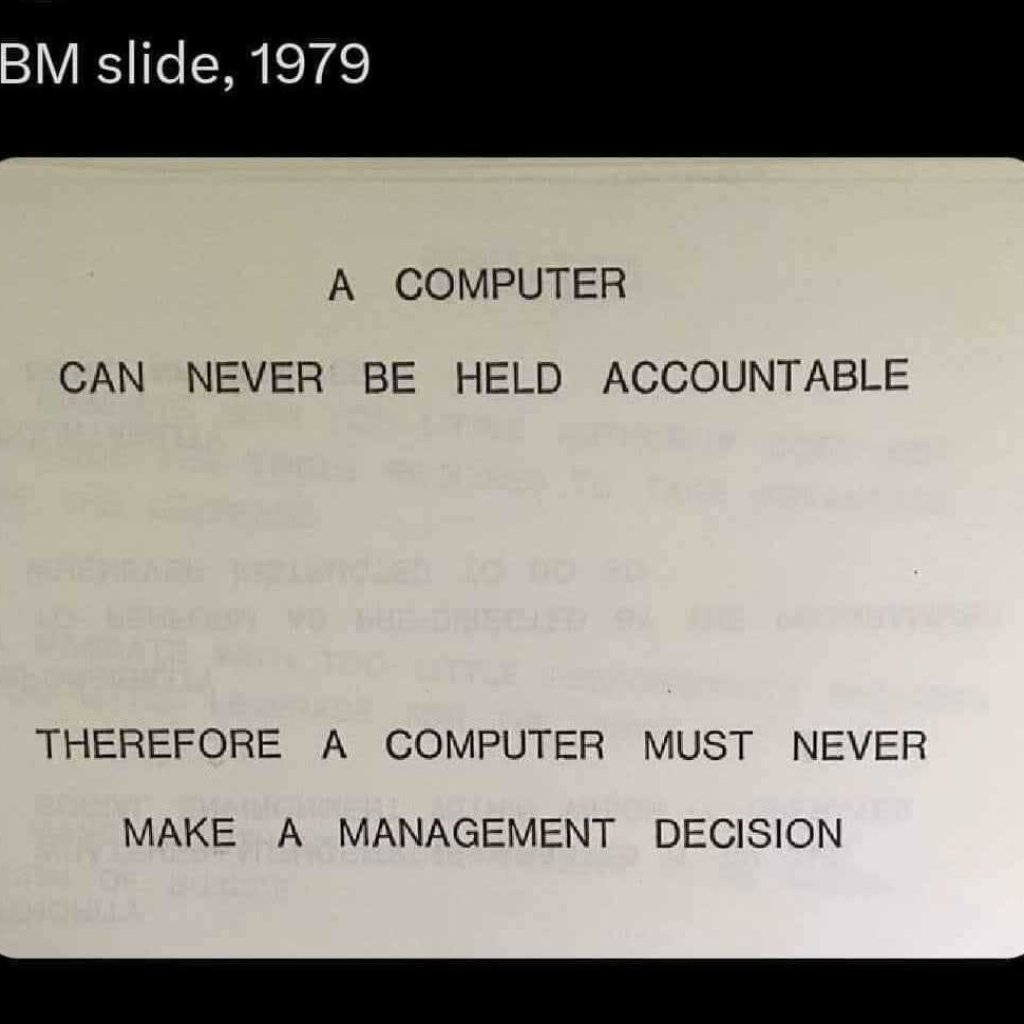

What was wild about the Native Instruments experience was that their software still wasn't Retina. It looked like something from the early 2000s on a modern display. And sadly, under the hood, a lot of it still was — NI's codebase for products like Traktor and Reaktor stretches back over 20 years. You could feel the age. It didn't feel like a company investing in the important stuff long-term. It felt like a company that would rather ship new sample packs on a schedule than modernize its foundations.

Sure enough, NI just entered preliminary insolvency proceedings in January 2026 — a German restructuring process overseen by a court-appointed administrator. And while their newest releases like Maschine 3 and Kontakt 8 have finally added HiDPI support, much of their software catalog still looks pixelated on a top-of-the-line MacBook in 2026. That's not just a technical shortcoming. It's a tell.

I ended up returning that Maschine and spending the extra on an Ableton Push. I was immediately glad I did. Ableton Live is basically as good as it gets for music production software. And the company clearly feels like it's in this for the long haul — they're still pushing firmware updates to the original Push from 2013, because when you only have a few pieces of hardware, you can afford to keep investing in them.

If you can tell the difference between a company playing the short game and one playing the long game, you probably already know who you should be doing business with.